As a bookkeeper, are you confident you have a clear and detailed contract with your clients that sets the right expectations?

Are you including everything from outlining the services you will provide, the payment terms and confidentiality agreements, and the terms by which either party can terminate the contract?

If you’re not sure where to start as you set out to create a contract template for your firm, or you’re doing some research to make sure your contract is as ironclad as it can be, this article has you covered.

We’ll discuss what to include in your bookkeeping contract and why having one is essential. You’ll also find a template to use as a foundation for creating your bookkeeping contract. Before we get started, let’s clarify that consulting a lawyer is recommended when drafting contracts or entering into binding agreements.

A bookkeeping services agreement or contract should include the following sections.

This section should also specify the bookkeeper’s responsibility to maintain the security of the client’s financial records and data and to protect such confidential information from unauthorized access. This is particularly important for small businesses since financial data is often the most sensitive information they have.

A bookkeeping agreement may vary depending on the jurisdiction and industry regulations. Consult a lawyer to ensure the contract complies with local and state laws and regulations.

You can also access this template as a Google Doc. Click on “File” in the upper left-hand corner, and select “Download” from the menu to choose your preferred document format.

Please note this template is for illustrative purposes only. It should not be interpreted as legal advice.

This Bookkeeping Services Contract (“Contract”) is entered into on [Date] by and between [Your Name] (“Bookkeeper”) and [Client Name] (“Client”).

Description of Services

The Bookkeeper shall provide the following bookkeeping services to the Client:

Payment Terms

The Bookkeeper shall be compensated at the rate of [hourly rate/flat fee] for services rendered.

The Client shall make payment to the Bookkeeper within [number of days] days of receipt of invoice.

Any late payments shall be subject to a [late payment amount] fee.

Confidentiality and Data Security

The Bookkeeper shall not disclose any confidential information regarding the Client’s business to any third party.

The Bookkeeper shall take all reasonable precautions to safeguard the Client’s financial data against unauthorized access.

Termination Clause

Either party may terminate this Contract upon [number of days] days written notice.

The Contract may also be terminated immediately if either party breaches any of its obligations under this Contract.

Contact Information

The Bookkeeper’s contact information: [Your contact information]

The Client’s contact information: [Client’s contact information]

Time Frame

The services shall be provided between the period of [start date] and [end date].

The services shall be provided on [frequency of service]

Signatures

This Contract constitutes the entire agreement between the parties. This Contract shall be binding upon and inure to the benefit of the parties hereto, their successors and assigns.

This Contract is governed by the laws of [Jurisdiction] and any disputes arising under or in connection with this Contract shall be resolved in accordance with the laws of [Jurisdiction].

By signing this contract, the client acknowledges that they have read and agreed to the terms and conditions outlined in this contract and that they understand their rights and responsibilities.

When creating an invoicing process for your clients, there’s no need to start from scratch. To give you a hand, Jetpack Workflow created a set of 32 workflow templates you can use and customize to simplify and streamline your general bookkeeping tasks and workflow processes.

Once you and your client have entered into a bookkeeping contract, the next step is for you to manage your client’s work. Meeting deadlines and adhering to expectations are vital to maintaining a positive client relationship.

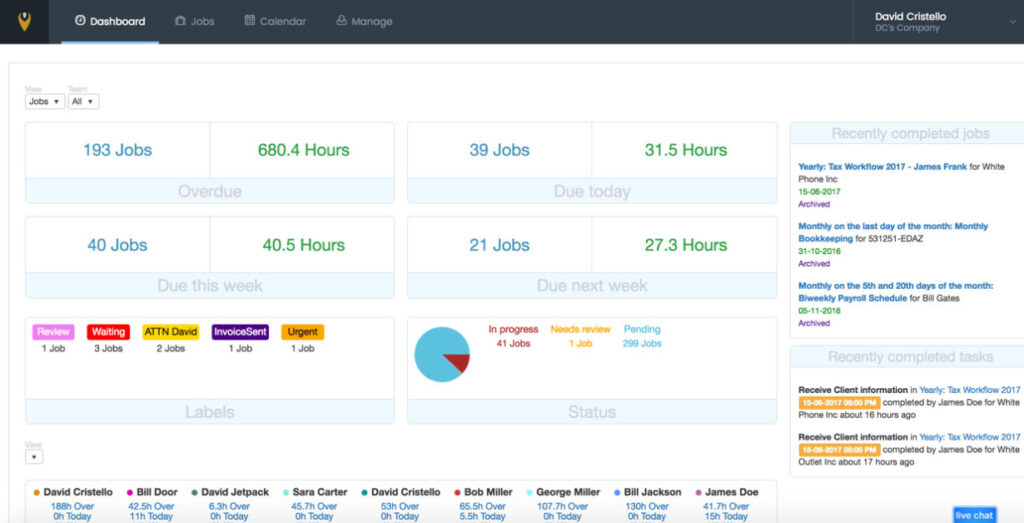

Jetpack Workflow is a cloud-based software solution designed for bookkeepers and accountants. It has pre-configured workflows for standard bookkeeping tasks like financial statement preparation and monthly accounting. Tailor Jetpack Workflow’s task management system to your bookkeeping firm’s needs so you meet every deadline effortlessly.

Learn more about Jetpack Workflow and start a free 14-day trial here.

Share this article

Subscribe to the Growing Your Firm weekly newsletter, and get the best accounting workflow templates today!

You’re an expert bookkeeper ready, willing, and able to help other businesses keep their accounts in balance. However, before you.

Packaging your bookkeeping services gives you a focused way to scale and grow your firm. And creating internal processes is.

A good introduction email to a new bookkeeping client shows you’re eager to get to work and dedicated to your.

Get under the hood of Jetpack Workflow’s accounting workflow and project management platform. See some of the top features and how it helps your firm standardize, automate, and track client work more efficiently.

Lessons learned on how top firms grow fast, build stronger teams, and increase profit while working less.

© 2024, Jetpack Workflow.

Ready to find out if workflow software is the right fit for your firm? Select the potential number of users at your company below to get started with your 14-day free trial.

No credit card required to get started.

“Now I have a birds eye view of what’s going on in my firm, so I know what my team is doing, and what’s the status and updates for our clients.”