This article is part of a larger series on Business Financing.

TABLE OF CONTENTSA business credit report contains information about your company’s finances and debt payment history. It can include things like recent applications for credit, details of your current credit account balances, and liens against your company.

Many lenders review business credit reports in determining whether to approve loan applications. The information in your report also determines your business credit scores, something that can impact the rates and terms you get on loans. For these reasons, it’s important to understand what information goes into your business credit report and how to read it.

Reports can be obtained from several different credit bureaus, and you can continue reading our guide to learn how to read a business credit report. Dun & Bradstreet (D&B) is one of the most commonly used solutions by lenders, and it provides a wide range of products and services that allow you to check and monitor your business credit.

Business credit reports are primarily used for three purposes. They’re used to verify identity, to evaluate whether your company will be approved for a loan, and to determine the rates and terms you’ll get.

A business profile is part of most business credit reports. It contains general information about your company, such as its name, address, and other unique identifying information. Lenders review this information to see if there are any discrepancies among your loan application, your supporting documents, and the business credit report. This process is done in part to verify that it’s evaluating the correct company and that funds are issued to authorized parties.

Business credit reports contain data about your company’s finances and repayment history. These speak to your company’s ability to take on more debt and track record of making timely payments, two critical factors that lenders consider when deciding whether to issue additional financing.

If you’re looking for a loan, we recommend heading over to our guide on how to get a small business loan to learn more about how you can improve your approval odds.

If you are approved for financing, the strength of your company’s finances and credit will typically dictate what rates and terms you’ll get. Lenders look at companies with strong finances and credit as less likely to default and will reward them with more favorable rates and terms.

Your business credit report contains various information about your company’s finances and loan repayment history. The exact details and format can vary depending on where you get your business credit report, but we’ll cover the most common sections using a sample report from Experian.

Many of these items are commonly evaluated as a small business loan requirement, so knowing what goes into your credit report can improve your chances of getting a loan.

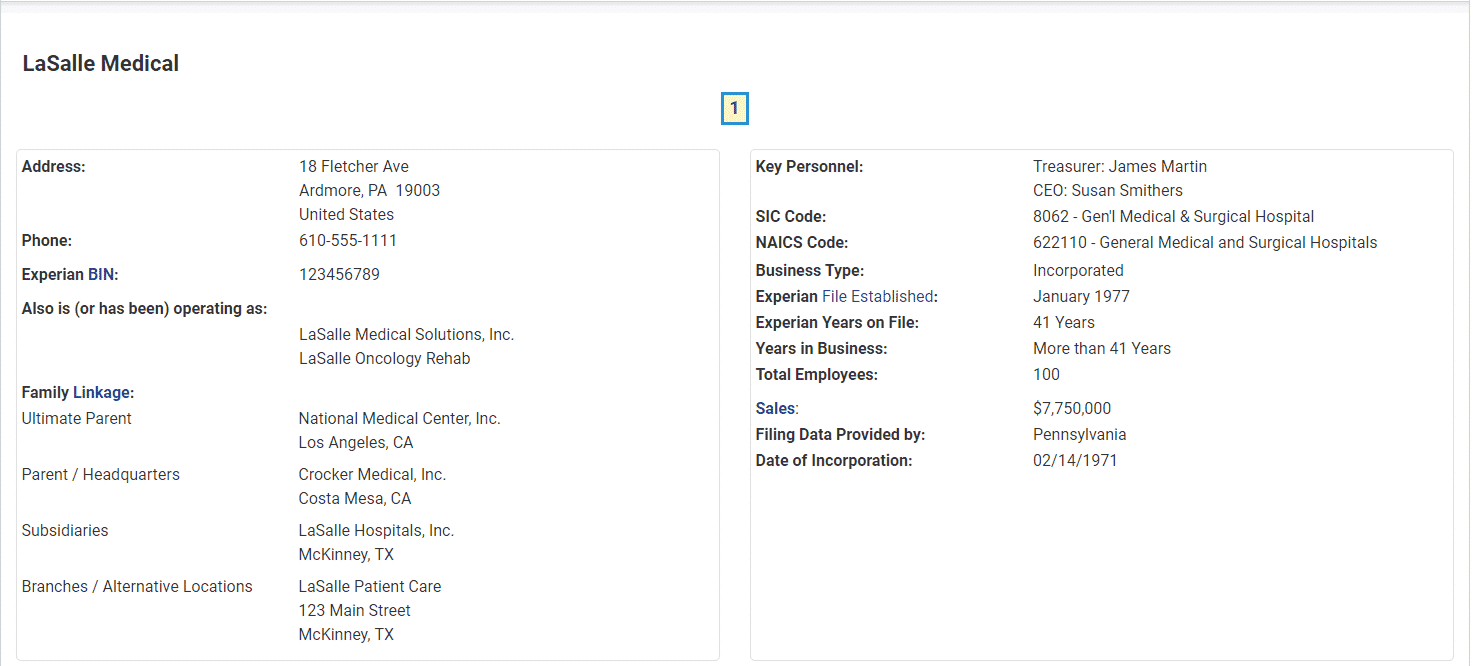

One of the first sections you’ll likely see on your business credit report is a general profile of your company.

A business profile section taken from a sample credit report by Experian for a fictitious business.

This section contains information about your business, such as your company’s name, address, and other contact information. While most of the items are self-explanatory, this section may also contain less commonly used terminology that may include the following:

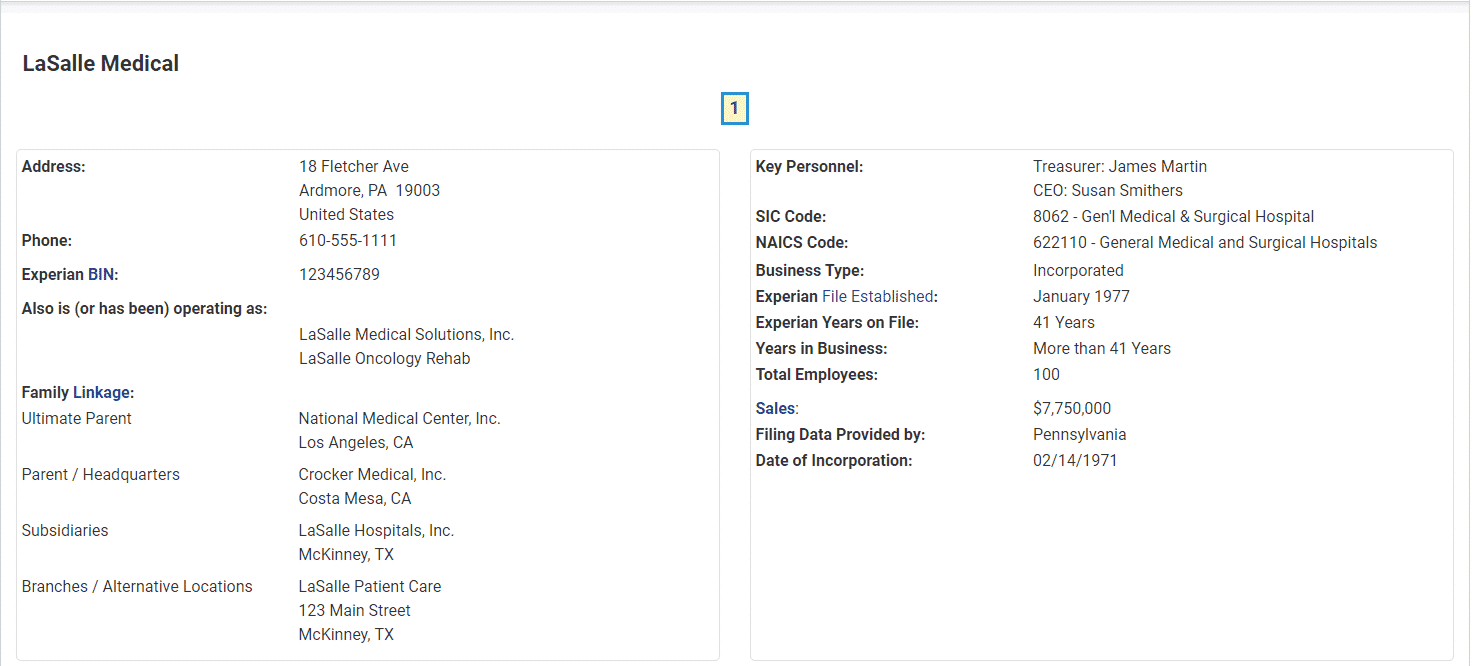

Depending on where you get your business credit report, you may also get a credit score. The image below is one example of a score you might get if you obtained a credit report through Experian.

An example of how Experian might display credit scores on its credit reports.

Credit scores are designed to illustrate your overall risk level, and different types of scores measure various risk factors. For example, some credit score models measure the likelihood of defaulting in the next 12 months, while others may assess the chance of your business going bankrupt.

Head to our guide on what a bad credit score is to learn about the common credit scoring models, how to check and calculate your credit score, and how to improve your credit score.

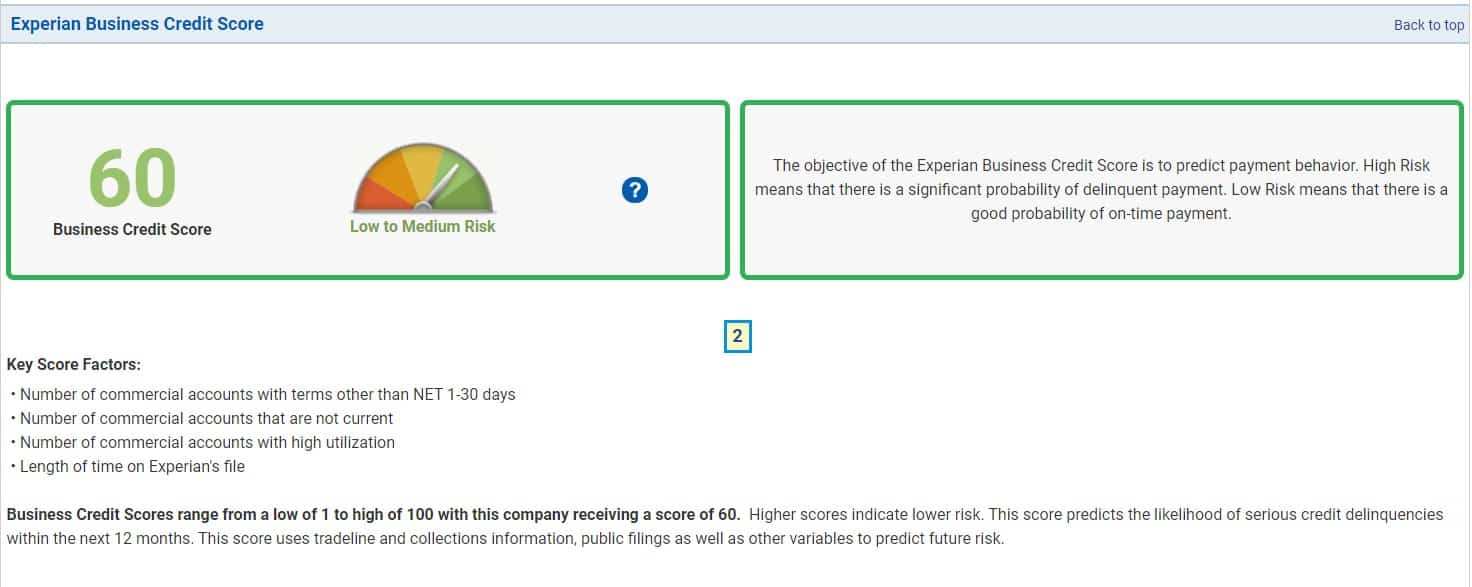

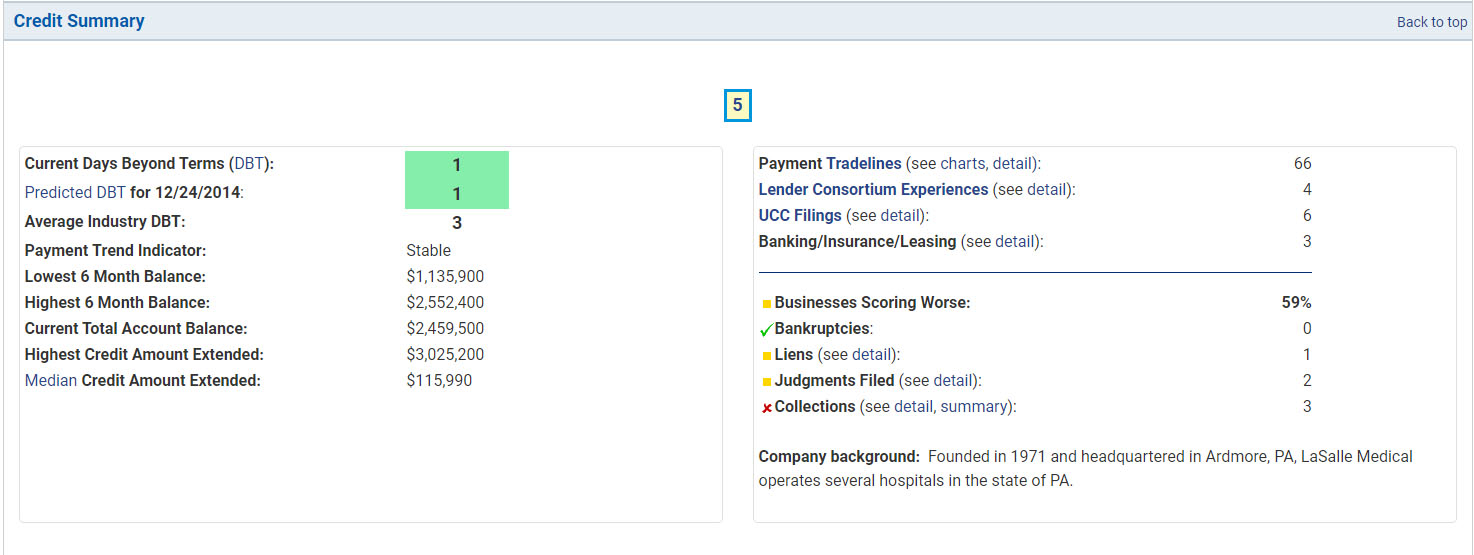

This section of your business credit report will provide a quick overview of various aspects of your credit. It will provide a summary of your loan payment history and reflect how you utilize your credit accounts. It will typically also include information on Uniform Commercial Code (UCC) liens for any assets that have been pledged as collateral.

Credit reports often include a summary of your credit history, such as this one on a sample Experian credit report.

Common items covered in this section include:

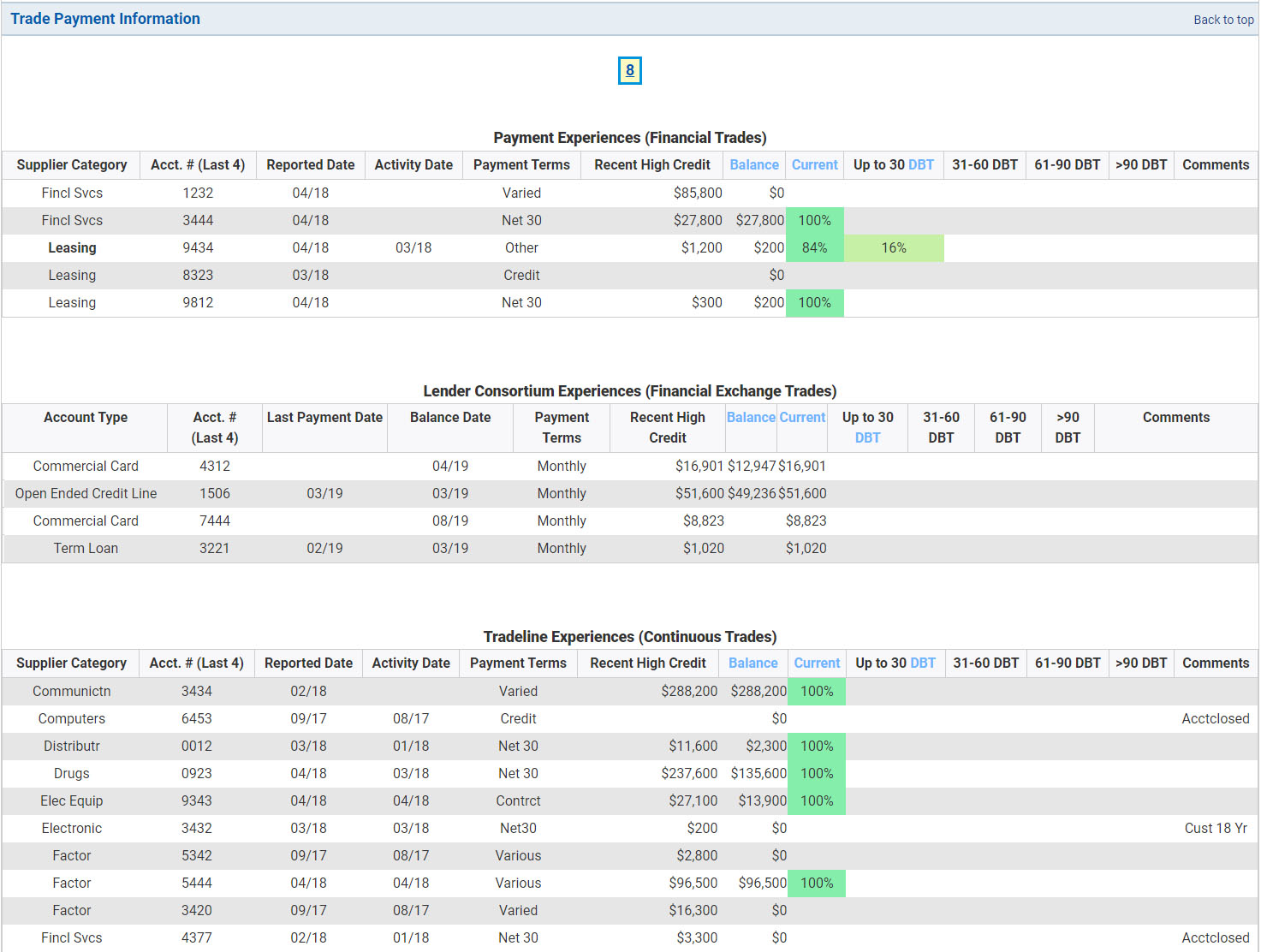

The payment history of your credit report will contain details about each of your individual accounts as reported by your creditors. Accounts can include credit cards, lines of credit, other loans, and payments to vendors. This will include detailed information about your payment history, account balances, payment terms, and payment amounts.

Your business credit report will also show details of individual tradelines.

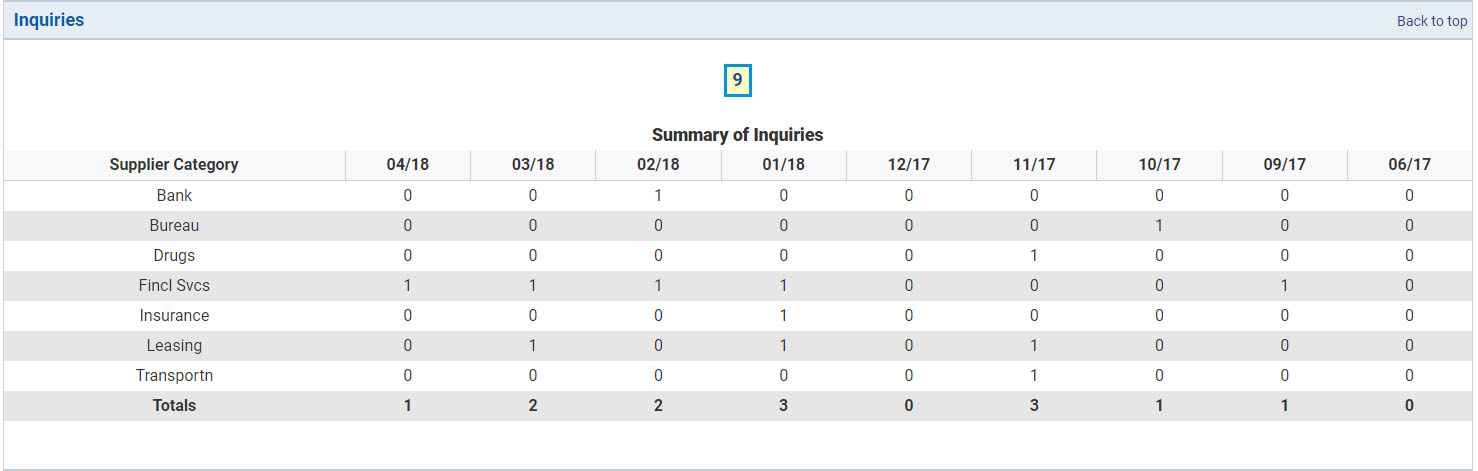

In most cases, lenders will check your business credit report when you apply for financing—and these requests will appear as a credit inquiry. Experian lists inquiries from the past nine months and breaks them down into which types of companies have checked your credit. Depending on the company you get your business credit report from, you may be able to see inquiries further back than nine months.

Creditors and other companies that have checked your credit will appear in the credit inquiries section of your credit report.

In general, lenders view businesses with a large number of inquiries as more risky. This is because it could be an early sign that a company may be overextended or desperate for credit. Businesses with few credit inquiries, by comparison, are seen to be at a lower risk as they have not demonstrated any need for credit or signs of possible financial distress.

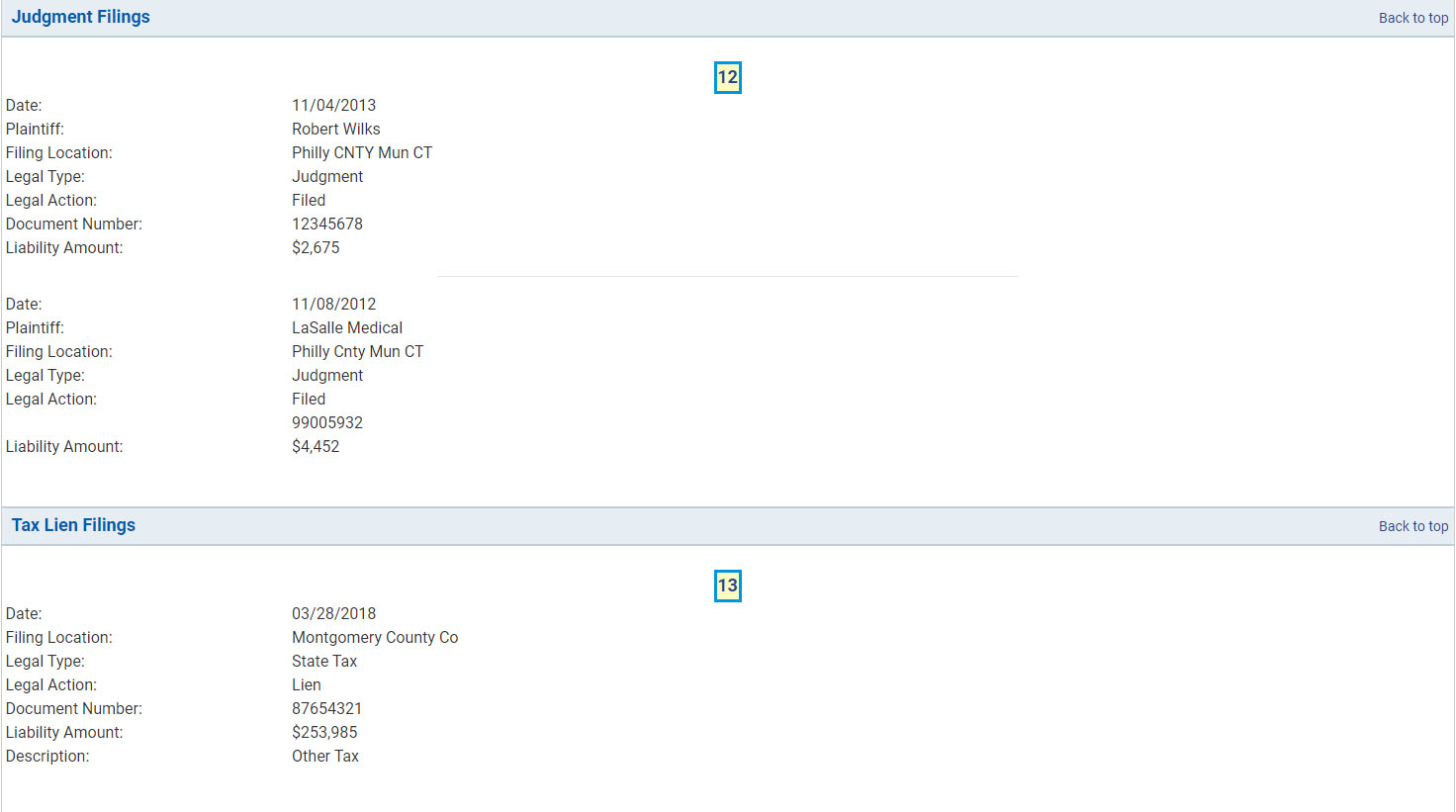

In addition to late payments, significant derogatory items will appear in this section. While some credit bureaus will separate items into individual categories, these items will typically include tax liens, collections, judgments, and bankruptcy filings.

Derogatory information often has its own section on your credit report.

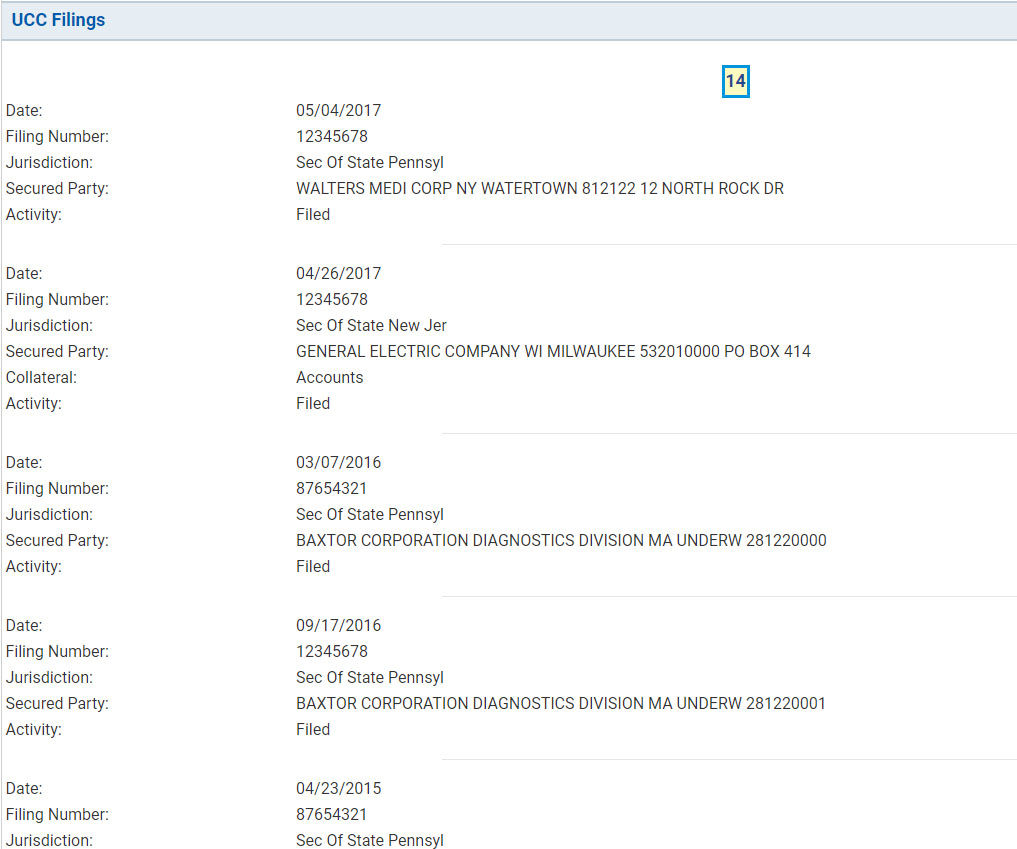

Business assets pledged as collateral will typically appear in the UCC filings section of your business credit report. Other lenders accessing this information will be able to see the date it was filed, the type of collateral being used, and the secured party.

Any assets pledged as collateral can be listed under the UCC filings section of your credit report.

UCC filings are used to lower the risk of lending money by claiming a public interest in the collateral, allowing the party to take legal possession of it in the event of a default. Common types of collateral that can be pledged include

The following are four providers that you can visit to get a copy of your business credit report. Each has additional products and services to help you monitor your credit and track your business credit score.

Keep in mind that since your credit report is simply a snapshot of data last reported from lenders, the information you see may vary among the different providers.

D&B is one of the most commonly used credit bureaus by lenders. It offers different types of business credit scores and multiple services to help companies monitor their credit. You can read our guide to D&B credit reports to learn more.

Experian issues a score called Intelliscore Plus. The most recent version of this, called Intelliscore Plus V3, has a range from 300 to 850, with higher scores being more favorable. A blended data option is also available for lenders wanting to combine business information with that of individual owners.

Some older versions of Intelliscore operated on a scale from 1 to 100, with scores above 75 generally regarded to be low risk for lenders. Visit Experian to learn more or to see what your credit score is.

Equifax has two main types of credit scores lenders can utilize, and you can visit the Equifax website to learn more or to purchase a credit score report.

FICO SBSS scores are most commonly used for Small Business Administration (SBA) loans. Scores range from 0 to 300, with higher scores representing lower risk for lenders. For most SBA loans, we recommend having an SBSS score of 155 or higher. You can visit Nav to obtain a copy of your FICO SBSS credit score.

Business credit reports are a snapshot of data reported to a particular credit bureau as of a specific date. If you obtained credit reports on different days, or your creditors did not report payment information to a particular credit bureau until later, it could explain any discrepancies you see.

What information is included in a business credit report?Business credit reports primarily contain information about your payment history and your company’s finances. This includes general information about your company, the industry it operates in, and its size.

How does my business credit report impact my credit score?Data from your business credit report is used to calculate your business credit scores. Depending on the type of credit score being used, certain elements of your credit report will be weighed more heavily than others.

Lenders use the information in your business credit report to determine whether to issue financing and at what rates and terms. Knowing how to read your credit report and being aware of what goes into it can expand your access to credit.

Dun & Bradstreet, Equifax, Experian, and Nav are four providers that can give you access to your various reports and credit scores. You can also take advantage of each company’s services to monitor changes to your business credit reports.